Buying a home

We’ll help guide the way for your first home loan journey

Buying your first home is an exciting journey. We want it to feel more like an epic adventure than a side hustle. Our lending specialists can help get you started with the right home loan.

Check below for a step-by-step guide to buying a property which may help you crack what all the jargon means. Use our calculator to see what you could afford and get the lowdown on the property market from our helpful tips and guides. You can even apply easily online.

Tips and guides

Explore a few tips to buying a property

Borrowing capacity

How much could I borrow?

Let’s crunch the numbers. Just input your income and expenses, and our borrowing calculator will estimate how much you could borrow and what the repayments would be.

Do you know which grants you could be eligible for?

Find out about government help you might be able to get based on your state

We’re award winning

That’s a win for you too

Our customers reap the benefits of our award-winning home loans.

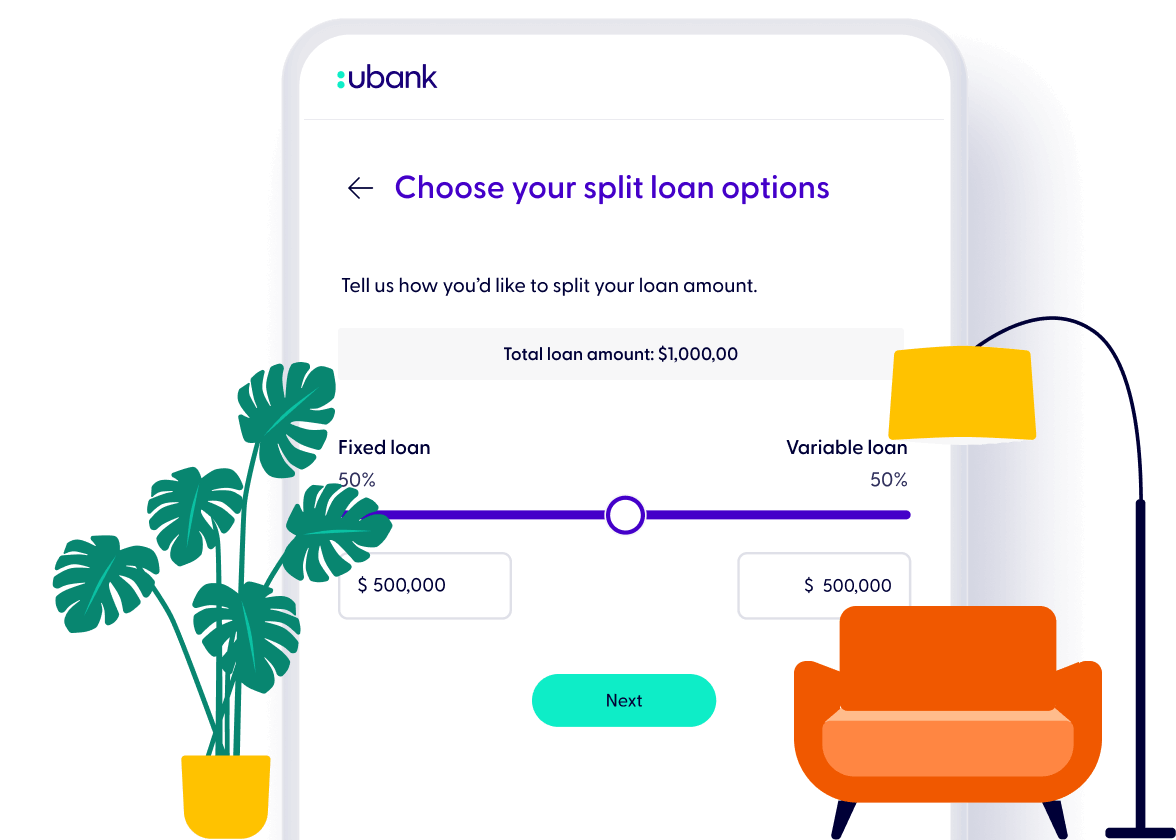

How to get a loan with us

Applying for a pre-approval is easy

1. See if we’re a good fit

Read our eligibility criteria and see if you’re eligible for a ubank loan

2. Apply online

Easy online application or talk with a lending specialist

3. Get a decision ASAP

If your application hits the mark, you’ll get an approval fast

4. Start home-hunting

Hit the open houses with full confidence in your finances

Want to chat about buying your first home?

Talk it over with one of our lending specialists.

Monday to Friday 9am-8pm, Sat and Sun 9am-6pm (Syd time)

FAQs

Have any questions?

Explore our home loan products

Find out everything there is to know about our home loan offerings

Want the key facts?

We’ll give you the key facts you need to know about your preferred loan.